child tax credit november 2021 late

November 12 2021 1226 PM CBS Pittsburgh. Enter your information on Schedule 8812 Form.

Taxpayers Demand For Extension Of Deadline For Filing Of Income Tax Returns As Date Nears In 2022 Filing Taxes Tax Return Income Tax Return

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

. 722 AM EST November 14 2021. But many parents want. The vast majority of parents who receive the child tax credit will get the full amount.

Some parents may see smaller child tax credit payments for the rest of 2021. The advanced Child Tax Credit payments are due out on the 15th day of each month over the second half of 2021 meaning that November 15. If Congress doesnt extend it.

Increases the tax credit amount. Filers can also earn 100 per. To start a trace complete Form 3911 and fax or mail it in.

The sixth Child Tax Credit payment kept 37 million children from poverty in December. The 2021 advance was 50 of your child tax credit with the rest on the next years return. Max refund is guaranteed and 100 accurate.

Individuals who earned less than 200000 in 2021 will receive a 50 income tax rebate while couples filing jointly with incomes under 400000 will receive 100. The credit is 3600 annually for. Late registrants and early recipients.

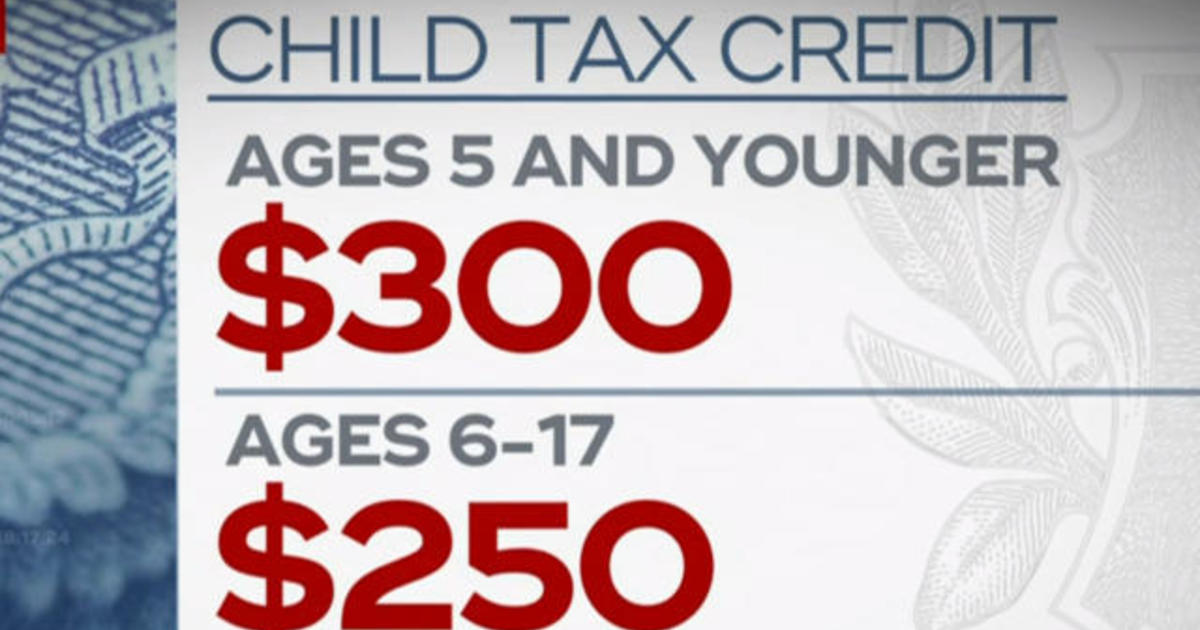

The IRS has been sending families half of their 2021 child tax credit as monthly payments of 300 per child under. Households on low incomes can still claim advance payments until November 15 with another tool which launched in September. 622 AM CST November 14 2021 Updated.

Ad Free means free and IRS e-file is included. Its too late to un-enroll from the November payment as the IRS deadline to opt out was on November 1. To reconcile advance payments on your 2021 return.

It is key to the Bidens administrations effort to. Simply The 1 Tax Preparation Software. Even if you dont owe taxes you could get the full CTC refund.

622 AM CST November 14 2021. The 2021 CTC is different than before in 6 key ways. Get your advance payments total and number of qualifying children in your online account.

This caused about 2 of child tax credit recipients to not only get payments late but also to get a little too. Of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased 2021 Child Tax Credit. The enhanced child tax credit which was created as part of the 19 trillion coronavirus relief package in March is in effect only for 2021.

November 15 2021. Makes the credit fully refundable. Ad Access IRS Tax Forms.

CBS Baltimore -- The fifth Child Tax Credit payment from the Internal Revenue Service IRS will be sent this coming Monday. There are a number of changes to the CTC in 2021 because of the American Rescue Plan Act of 2021 which President Biden signed into law on March 11 2021. The fifth installment of the advance portion of the Child Tax Credit CTC payment is set to hit bank accounts today November 15.

The advance is 50 of your child tax credit with the rest claimed on next years return. November 11 2021 142 PM 2 min read. But a problem with the September payment means some will get less.

In absence of a January payment though the monthly child poverty rate could potentially increase from 121 percent to at least 171 percent in early 2022the highest monthly child poverty rate since December 2020. SOME families who signed up late to child tax credits will receive up to 900 per child this month. The tax credits maximum amount is 3000 per child and 3600 for children under 6.

If you qualify for the advance Child Tax Credit you can expect your next payment to hit your bank account by Nov. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. The November advance child tax credit payment comes Monday to millions of Americans.

Its not too late you can still file your tax return to get the Child Tax Credit and thousands of dollars of additional tax benefits. You Answer Simple Questions About Your Life We File Your Return. This caused about 2 of child tax credit recipients to not only get payments late.

Removes the minimum income requirement. Try It Yourself Today. Instructions on where to send it are at the bottom of the form.

Complete Edit or Print Tax Forms Instantly.

When Will The 2021 Child Tax Credit Payments Start Under Stimulus Relief The Turbotax Blog

Child Tax Credit Monthly Payments To Begin Soon The New York Times

The December Child Tax Credit Payment May Be The Last

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

Child Tax Credit 2021 What To Do If You Didn T Get A Payment Or Got The Wrong Amount Cbs News

Is The Enhanced Child Tax Credit Getting Extended This Year Here S The Latest Cnet

Is The Enhanced Child Tax Credit Getting Extended This Year Here S The Latest Cnet

Payments From The Expanded Child Tax Credit Are Being Sent Out Npr

Parents Guide To The Child Tax Credit Nextadvisor With Time

Child Tax Credit 2021 What To Do If You Didn T Get A Payment Or Got The Wrong Amount Cbs News

What To Do If You Still Haven T Received Your Child Tax Credit Payment Forbes Advisor

Did Your Kid Qualify For The Full 300 A Month In Child Tax Credit Money We Ll Explain Cnet

Will Monthly Child Tax Credit Payments Be Renewed Forbes Advisor

Where S My Child Tax Credit Payment A Guide For Frustrated Parents The Washington Post

Child Tax Credit Schedule 8812 H R Block

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

Monthly Child Tax Credit Payments Begin Today Here S How Much You Can Expect Nextadvisor With Time

Figure Pay Qualities With Our Free Pay Charge Instrument That Will Pull In Salaried Stars Of Government And Private D Income Tax Return Income Tax Filing Taxes